The High Cost of Waiting: How Delaying Your Retirement Plan by 5 Years Can Cost You Lakhs

The High Cost of Waiting: How Delaying Your Retirement Plan by 5 Years Can Cost You Lakhs

Retirement planning is one of the most important aspects of financial stability, yet it is often postponed due to immediate priorities such as home loans, education expenses, or lifestyle choices. While these concerns are valid, delaying retirement planning in India can have a significant financial impact. Even a delay of just five years can reduce the size of your retirement corpus by several lakhs, altering the quality of life you can afford after you stop working.

Thank you for reading this post, don't forget to subscribe!This article examines the cost of late retirement planning, the financial implications of postponing savings, and how individuals can approach retirement planning more efficiently.

Why Timing Matters in Retirement Planning

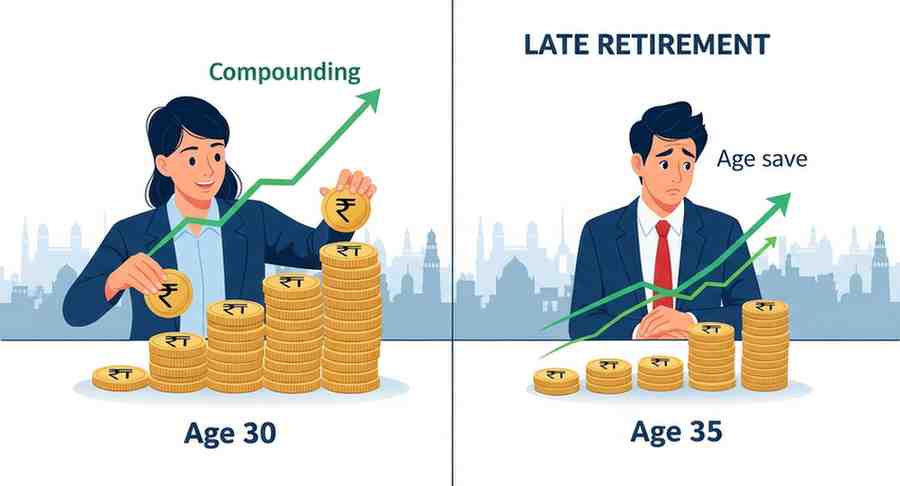

Retirement planning is not only about the amount you save, but also about when you start saving. The earlier you begin, the more time your investments have to grow through the power of compounding. For example, if you invest ₹15,000 every month in a retirement-oriented investment vehicle at an average annual return of 10%, starting at age 30 versus age 35 can make a significant difference. The five-year delay reduces the compounding period, which directly translates into a smaller retirement corpus.

This illustrates how the impact of delaying retirement savings can extend beyond numbers—it influences the financial security and choices available in your later years.

The Cost of Late Retirement Planning

The cost of late retirement planning is often underestimated. Postponing contributions by five years can shrink your corpus by several lakhs, depending on the investment horizon and return expectations. To put this into perspective:

- Starting at 30 years old: ₹15,000 monthly for 30 years at 10% return can grow to over ₹3.4 crore.

- Starting at 35 years old: The same investment for 25 years may accumulate only around ₹2 crore.

This difference of over ₹1 crore highlights the financial gap created by simply waiting. While actual returns may vary, the opportunity cost of lost compounding years is undeniable.

Common Retirement Planning Mistakes to Avoid

When analyzing why individuals end up with inadequate retirement funds, several mistakes emerge:

- Postponing the Start: Many people assume they can begin investing later, often underestimating the loss from delayed compounding.

- Underestimating Expenses: Inflation significantly increases future living costs. A monthly expense of ₹50,000 today could double in about 15 years.

- Relying on One Asset Class: Some depend solely on fixed deposits or property, without diversifying across mutual funds, equities, and other financial instruments.

- Ignoring Healthcare Costs: Rising medical expenses can severely affect retirement finances if not accounted for early.

- Withdrawing from Retirement Corpus: Using long-term investments for short-term needs can disrupt the growth of retirement savings.

Recognizing these retirement planning mistakes to avoid can help individuals prepare better and secure financial independence in old age.

The Psychological Bias Behind Delaying Retirement Planning

Apart from financial considerations, behavioural factors also play a role in delaying retirement planning in India. Many individuals prioritise present consumption over long-term security, influenced by optimism bias—assuming they will “catch up later.” Others rely excessively on employer-provided retirement schemes such as EPF (Employees’ Provident Fund), without supplementing them with personal investments.

This mindset often leads to under-preparation, leaving individuals financially constrained after retirement. Identifying and overcoming these psychological barriers is as important as choosing the right financial instruments.

How to Start Retirement Planning Early in India

Beginning retirement planning early does not require large sums; it requires consistency and discipline. Here are some practical steps:

- Start Small, Increase Gradually: Even if you can only set aside ₹5,000 per month initially, the habit of saving and investing early is more valuable than waiting for a higher disposable income.

- Choose Suitable Instruments: Equity mutual funds, retirement-focused pension schemes, National Pension System (NPS), and even Public Provident Fund (PPF) can be part of a diversified retirement strategy.

- Account for Inflation: Retirement planning must factor in inflation-adjusted returns. Real returns matter more than nominal returns.

- Set Realistic Goals: Estimate your retirement corpus based on expected expenses, lifestyle choices, and healthcare costs. Online calculators can help in setting achievable targets.

- Seek Professional Advice: Financial planners can provide personalised strategies tailored to income, goals, and risk tolerance.

By following these steps, individuals can better understand how to start retirement planning early in India, ensuring financial preparedness without drastic compromises later.

The Broader Impact of Delayed Retirement Savings

Delaying retirement savings has consequences beyond personal finance. It may lead to extended working years, reduced quality of life, or reliance on family members for support. In a country where social security systems are limited, personal responsibility for retirement planning becomes even more critical.

For professionals in their 30s and 40s, the opportunity cost of postponing savings is magnified. With increasing life expectancy, retirement may last 20–30 years, requiring careful financial preparation. Delays reduce flexibility, often forcing individuals into higher-risk investments later in life to make up for lost time.

Conclusion

Retirement planning requires foresight and commitment. A delay of just five years may not seem significant today, but over the long term it can cost several lakhs and substantially reduce your financial comfort during retirement. The cost of late retirement planning is not limited to numbers—it is reflected in lifestyle compromises, healthcare constraints, and the lack of financial independence.

By avoiding common mistakes and understanding the impact of delaying retirement savings, individuals can make informed decisions. Starting early, even with modest amounts, ensures that compounding works in your favour and provides greater security for the future.

In essence, retirement planning is about timing as much as it is about the amount saved. The earlier you begin, the more you gain, and the more flexibility you retain for the years when your income stops but your needs continue.

Related Blogs:

Top 3 Retirement Investment Options in India Compared

The Practical Guide to Retirement Planning with Mutual Funds in India

What is the Employee Pension Scheme

How to Use Mutual funds and ETFs for Instant Portfolio Diversification

NPS (National Pension System): A Tax-Saving Retirement Tool

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.