Are Renewable Energy Stocks the Hidden Winners of India’s EV Push?

Are Renewable Energy Stocks the Hidden Winners of India’s EV Push?

India’s electric vehicle (EV) market is gaining momentum, driven by government incentives, rising fuel costs, and consumer interest in sustainable mobility. While EV manufacturers and battery producers often dominate discussions, the impact of the EV market on renewable energy stocks in India is becoming increasingly significant. As charging demand rises and grid dependency grows, renewable energy companies are emerging as indirect beneficiaries of the EV transition.

Thank you for reading this post, don't forget to subscribe!This article explores how EV adoption is reshaping energy demand, the role of renewable firms in meeting this requirement, and the potential stock market opportunities in India’s clean energy and EV sector.

The Link between EV Adoption and Renewable Energy Demand

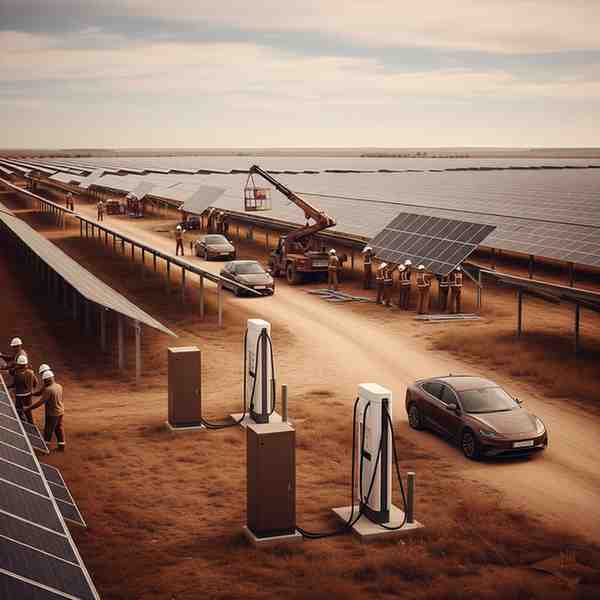

Electric mobility requires reliable and large-scale charging infrastructure. As more EVs hit Indian roads, the electricity demand curve is expected to shift upward. To meet this demand sustainably, there is growing emphasis on integrating renewable energy sources—such as solar and wind—into the power supply for EV charging stations.

For policymakers and corporates, this is not only a matter of expanding infrastructure but also of reducing carbon emissions. Using fossil-fuel-based electricity to charge EVs dilutes their environmental benefit. Consequently, the EV charging demand and renewable energy sector in India are increasingly interlinked, creating opportunities for renewable power producers.

Renewable Energy Companies Benefiting from EV Growth

Several renewable energy companies benefiting from EV growth are beginning to align their strategies with the needs of the mobility sector:

- Solar Energy Providers: Solar rooftop and utility-scale projects can directly power EV charging stations, particularly in commercial hubs and highways.

- Wind Energy Producers: Wind energy companies are exploring supply partnerships with distribution companies (DISCOMs) that are expected to serve high-load charging networks.

- Hybrid Energy Projects: Combining solar, wind, and storage solutions can ensure round-the-clock clean energy availability for EV charging infrastructure.

In India, companies such as NTPC Green Energy, ReNew Power, and Tata Power Renewable Energy have already taken steps towards integrating renewables with EV charging solutions.

How EV Charging Infrastructure Drives Investment in Renewables

The development of EV charging networks has implications beyond the auto industry. It stimulates the growth of renewable capacity by encouraging companies to expand solar and wind installations, often supported by battery storage systems. This dynamic has positioned renewables as a critical partner in the EV transition.

- Urban Charging Stations: Distributed solar plants can support charging hubs in metropolitan areas.

- Highway Corridors: Green energy projects are being linked to fast-charging stations across state and national highways.

- Corporate Fleets: Companies adopting EV fleets are increasingly investing in captive renewable energy projects to offset energy consumption.

This interdependence reflects how EV adoption is driving renewable energy investments in India, not only through capacity expansion but also by pushing innovation in storage and grid management.

Stock Market Opportunities in India’s Clean Energy and EV Sector

For investors, the interaction between EV adoption and renewable energy opens new avenues in the stock market. Companies with diversified portfolios that include renewable energy generation, energy storage, and EV charging infrastructure are likely to see increasing relevance.

Some notable trends include:

- Integrated Energy Players: Firms that operate in both conventional and renewable segments are expanding into EV charging solutions, thereby widening their revenue streams.

- Renewable-Focused Firms: Pure-play renewable companies are leveraging EV-related demand to secure long-term power purchase agreements (PPAs) with charging networks and corporates.

- Ancillary Businesses: Battery storage firms, grid management software providers, and equipment manufacturers supporting renewable-EV integration are also attracting investor interest.

For retail and institutional investors, evaluating stock market opportunities in India’s clean energy and EV sector requires an understanding of how companies position themselves within this ecosystem.

Policy and Regulatory Landscape for EV Adoption and Renewable Energy Investments in India

Government policies are playing a critical role in shaping the relationship between EVs and renewable energy. Initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, Renewable Energy Purchase Obligations (RPOs), and state-level incentives for charging stations have created an enabling environment.

Additionally, the push for Green Open Access Rules allows EV charging companies to source renewable energy directly from producers, bypassing traditional distribution channels. This framework is expected to accelerate long-term contracts between charging firms and renewable generators.

Challenges in EV Charging Demand and Renewable Energy Sector in India: Key Considerations for Investors

While the growth outlook appears positive, some challenges remain:

- Grid Reliability: Integrating intermittent renewable sources with charging demand requires robust grid infrastructure and storage solutions.

- Cost Considerations: Despite declining solar and wind tariffs, the cost of storage and distribution remains a concern.

- Policy Clarity: Investors often seek greater clarity on tariffs, subsidies, and long-term regulatory stability before committing capital.

These factors highlight the importance of risk assessment before investing in renewable stocks linked to EV demand.

Impact of EV Market on Renewable Energy Stocks in India and Emerging Investment Opportunities

The shift towards electric mobility is not just transforming the automotive sector but also reshaping the broader energy market. The impact of the EV market on renewable energy stocks in India lies in how effectively renewable companies can position themselves as reliable energy partners for this growing demand.

For businesses, this means aligning strategies with the EV ecosystem, expanding renewable generation capacity, and investing in storage technologies. For investors, it offers an emerging opportunity to participate in India’s clean energy transition while monitoring how companies adapt to evolving demand patterns.

Conclusion

The EV sector’s rapid growth is more than an automotive story—it is also an energy transformation narrative. As EV charging expands, the reliance on clean power will strengthen the renewable energy sector, making these companies important stakeholders in India’s mobility future.

For investors, the evolving relationship between EVs and renewables underscores the need to track renewable energy companies benefiting from EV growth and evaluate their positioning in the clean energy ecosystem. In this way, the EV adoption driving renewable energy investments in India represents both a challenge and an opportunity—shaping the long-term trajectory of the country’s energy and stock markets.

Related Blogs:

India’s Semiconductor Sovereignty: The Geopolitical Tailwinds Boosting Domestic Stock

How the ‘Semicon India’ Program is Supercharging Semiconductor Stocks

India’s Sunrise Sector: Why Semiconductor Stocks are a Must-Watch for Smart Investors

Best Semiconductor Stocks in India

Why Does Your Portfolio Need Semiconductor Stocks?

Best Semiconductor Stocks in India 2024

Top 5 Semiconductor Stocks in India

Top 5 Cybersecurity Stocks in India

Best Cybersecurity Stocks in India

Can Defense Stocks Shield Your Investment Portfolio?

Investing in the Convergence of Cybersecurity and Data Centers

Top Trends in Data Centers and Cybersecurity in India: What Investors Need to Know

Riding the Wave: How Technology is Reshaping Stock Trading

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.