Impact of Rupee Movement on Indian Equities

Impact of Rupee Movement on Indian Equities

The Indian stock market does not operate in isolation—it is influenced by multiple domestic and global factors. One of the most critical drivers is the movement of the Indian Rupee (INR) against foreign currencies, particularly the U.S. Dollar (USD). Since India is a trade-heavy economy, fluctuations in currency value can significantly impact different sectors, corporate earnings, and overall investor sentiment.

Thank you for reading this post, don't forget to subscribe!In this blog, we’ll break down how the rupee’s appreciation and depreciation influence Indian equities, the sectors most affected, and what investors should keep in mind.

Why Does the Rupee Matter for Equities?

The value of the rupee directly affects imports, exports, foreign investments, and corporate earnings. For companies dependent on global trade, even small currency fluctuations can alter profit margins. Additionally, FIIs (Foreign Institutional Investors), who play a major role in Indian equities, closely track currency stability before investing.

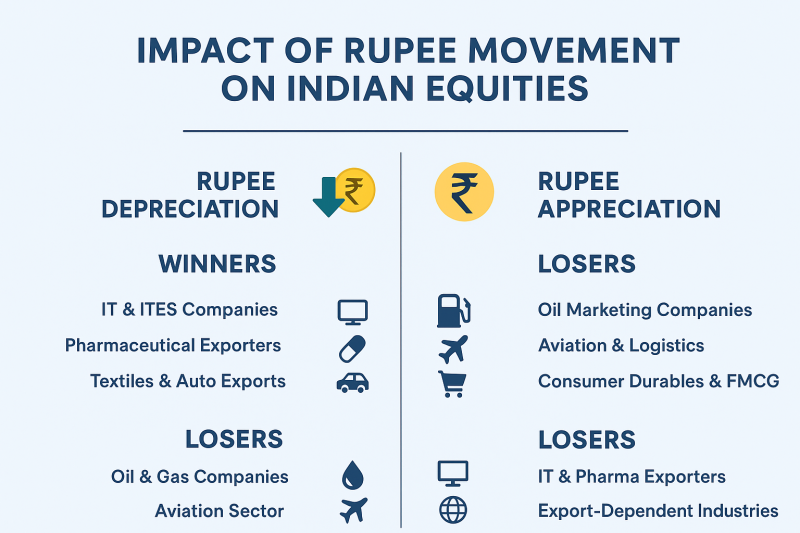

Rupee Depreciation: Who Benefits and Who Loses?

When the rupee falls against the dollar, it usually means imports become costlier, but exporters gain an advantage.

Winners:

-

IT & ITES Companies (Infosys, TCS, Wipro) – They earn a large share of revenues in USD, so a weaker rupee boosts profitability.

-

Pharmaceutical Exporters (Sun Pharma, Dr. Reddy’s) – Similar to IT, pharma companies gain from higher export revenues.

-

Textiles & Auto Exports (Tata Motors, Bajaj Auto) – Export-heavy businesses benefit from favorable exchange rates.

Losers:

-

Oil & Gas Companies (HPCL, BPCL, IOC) – India imports nearly 85% of its crude oil. A weaker rupee raises costs, pressuring margins.

-

Aviation Sector (IndiGo, SpiceJet) – Fuel imports and dollar-denominated expenses increase, reducing profitability.

-

FMCG Companies (HUL, Nestlé India) – Raw materials sourced globally become more expensive, impacting costs.

Rupee Appreciation: Who Benefits and Who Loses?

When the rupee strengthens, imports get cheaper but exporters face challenges.

Winners:

-

Oil Marketing Companies – Reduced import bills lower raw material costs.

-

Aviation & Logistics – Fuel becomes cheaper, improving margins.

-

Consumer Durables & FMCG – Raw material imports cost less, helping companies expand margins.

Losers:

-

IT & Pharma Exporters – Earnings in foreign currencies translate into fewer rupees, reducing profitability.

-

Export-Dependent Industries – Companies lose price competitiveness in global markets.

Role of FIIs and DIIs

-

Foreign Institutional Investors (FIIs): A falling rupee often triggers outflows, as foreign investors lose confidence in currency stability.

-

Domestic Institutional Investors (DIIs): They usually step in to stabilize markets during high volatility, but cannot always offset heavy FII outflows.

Historical Impact of Rupee Movements

-

2013 Taper Tantrum: Rupee depreciation to near ₹68/USD triggered a sharp market correction, especially in banking and oil stocks.

-

2020 Pandemic: Despite a weak rupee, Indian IT and pharma stocks surged due to high global demand.

-

2022 Energy Crisis: Rising oil prices coupled with rupee weakness led to underperformance in oil, aviation, and FMCG sectors.

How Should Investors React?

-

Diversify Sector Exposure – Balance portfolios with both import-heavy (FMCG, aviation) and export-driven (IT, pharma) sectors.

-

Track Global Cues – U.S. Fed policy, crude oil prices, and geopolitical tensions often dictate rupee movement.

-

Use Currency Hedging Instruments – Investors trading in F&O can use currency futures to hedge exposure.

-

Stay Long-Term Focused – Short-term volatility due to currency shifts should not derail long-term investment strategies.

Final Thoughts

Rupee fluctuations are inevitable in an open economy like India. While exporters cheer a weaker rupee and importers benefit from a stronger rupee, long-term investors should focus on building diversified portfolios. Keeping an eye on currency trends, global interest rates, and crude oil prices can help investors navigate volatility better.

In the end, it’s not just about the rupee—it’s about how you position your portfolio to balance risks and opportunities.

Related Blogs:

The Role of RBI’s Monetary Policy in Stock Price Movements

Impact of FIIs and DIIs on the Indian Stock Market

Secrets of Smart Money: How FII & DII Data Reveal Market Direction

Disclaimer: This blog post is intended for informational purposes only and should not be considered financial advice. The financial data presented is subject to change over time, and the securities mentioned are examples only and do not constitute investment recommendations. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.